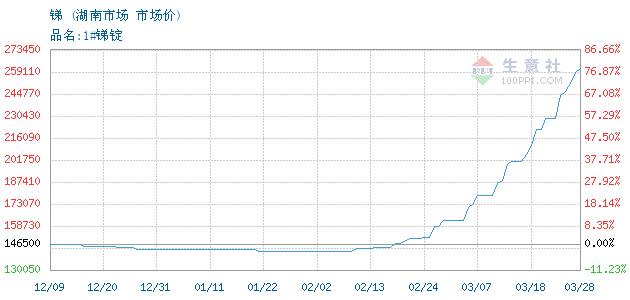

At present, the transaction price of antimony ingots in the market has gradually broken through the high level, but the transaction volume is relatively limited, and the market inquiry activity is relatively high. Downstream enterprises mainly purchase based on rigid demand, and some antimony trioxide (99.8%) orders after the Spring Festival with a price of about 120,000-130,000 yuan/ton have not yet been delivered.

In terms of supply, the price gap between domestic and foreign antimony ingots continues to widen, resulting in a reduction in the supply of imported ore. At the same time, affected by environmental factors, mines in the northwest have not yet started, and the tight supply of raw materials has further intensified. From January to February 2025, the supply of antimony industry products (converted into antimony ingots) was about 14,000 tons, a year-on-year decrease of 3.1%; the price difference between antimony ingots at home and abroad has curbed the problem of raw material supply. In December 2024, the import of antimony ore was 2068.94 tons, a month-on-month decrease of 63.85%. It is estimated that the import volume of antimony ore in January and February 2025 will be 1,500 tons, a year-on-year decrease of 80.7%. The domestic antimony industry relies on overseas resources at around 40%, and the reduction of imported resources will inevitably lead to tight supply.

In terms of downstream demand, the operating rate of the photovoltaic industry has not seen a significant recovery, and the growth space in the flame retardant field is limited. The continuous rise in upstream prices has increased the cost pressure of downstream companies and limited their ability to undertake. At present, downstream companies basically purchase according to orders and dare not increase inventory. The quantitative procurement model has further stimulated support for high-priced transactions.

The price of raw antimony concentrate has risen due to scarce supply, further pushing up the prices of downstream products such as ethylene glycol antimony and sodium pyroantimonate, increasing the cost pressure of the entire industrial chain.